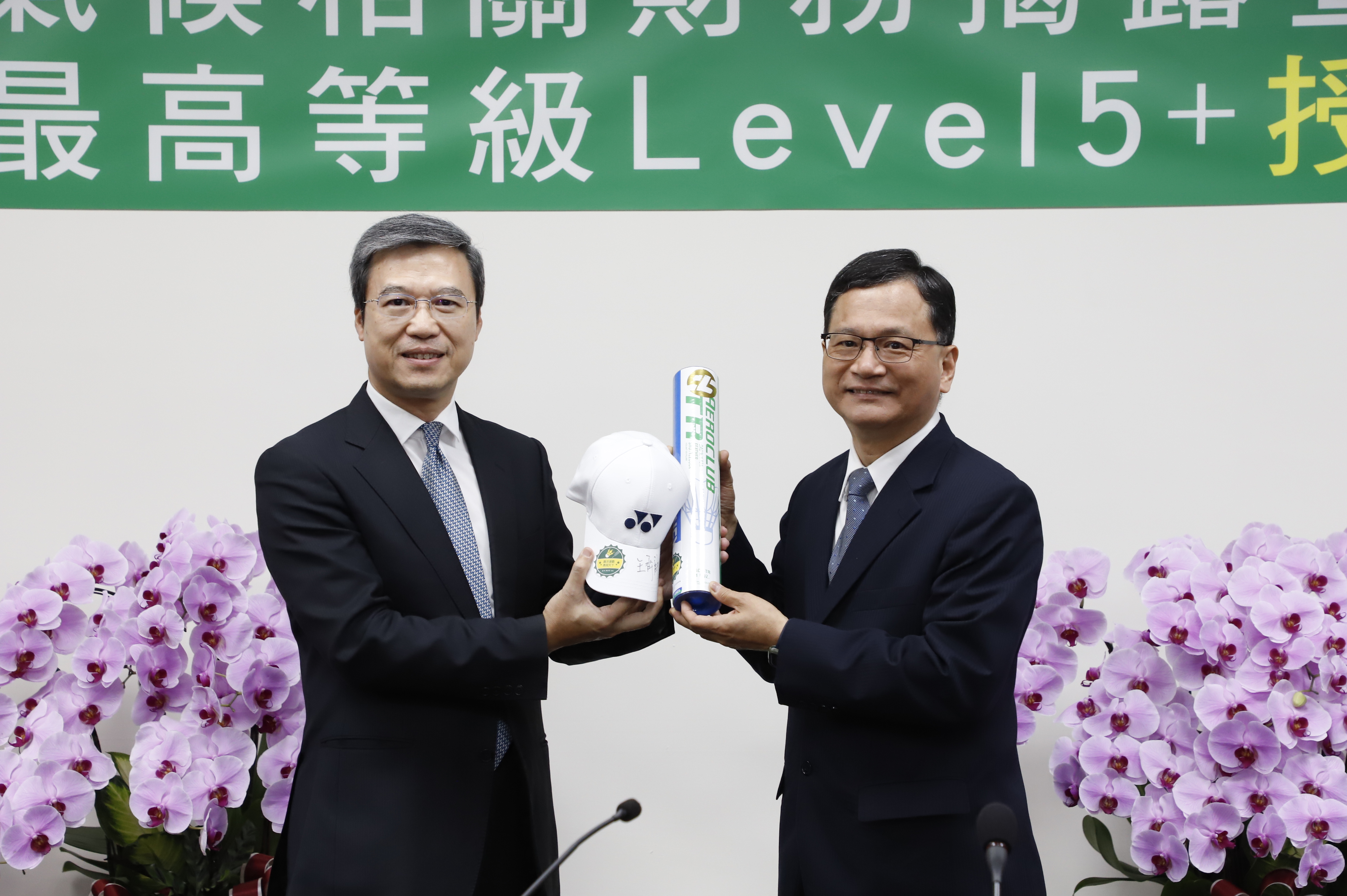

To demonstrate its steadfast commitment to sustainable development, Land Bank of Taiwan signed on to the Task Force on Climate-related Financial Disclosures (TCFD) in April 2022. The bank continues to adopt international methodologies to enhance risk management, focusing on “Governance,” “Strategy,” “Risk Management,” and “Metrics and Targets” to improve its climate risk management framework. Following third-party verification by the British Standards Institution (BSI), Land Bank of Taiwan has been awarded the highest audit level, “Level 5+: Excellence,” by British Standards Institution (BSI), confirming that its TCFD practices meet international standards.

The bank has long been dedicated to sustainability and has actively participated in green finance initiatives, including various carbon reduction and environmental protection programs. It has set clear net-zero emission goals and is progressively achieving green transformation in its operations. The bank offers a range of green deposit, green loan, and green bond products, including leading sustainable performance-linked syndicated loans and issuing sustainable development bonds. It also focuses on opportunities in the green energy sector by providing “Green Power Purchase Trust” services and promoting the use of green building materials, energy-efficient low-carbon technologies, and seismic-resistant facilities through its “Green Building Financing Marketing Plan.”

Additionally, to reduce its own carbon footprint, the bank has implemented paperless operations, adopted energy-efficient equipment, and used renewable energy. Its headquarters has achieved international certifications for “ISO 50001 Energy Management Systems” and “ISO 14001 Environmental Management Systems.” The bank has also completed greenhouse gas inventories for all domestic and international operations, obtaining an “ISO 14064-1 Greenhouse Gas Verification Statement.” Key carbon reduction initiatives include upgrading its air conditioning systems and using solar power for self-consumption, which are central to its carbon reduction and sustainability efforts.

In line with international initiatives, the bank has signed and implemented the Equator Principles and produces annual sustainability reports following the global standards such as the Global Reporting Initiative (GRI). These reports, along with information on the corporate website and annual reports, enhance the quality and transparency of ESG disclosures.

To boost its sustainability competitiveness, the bank has made “Leading with Green Finance, Spreading Wings, and Sustainable Co-Prosperity” its operational focus for 2024. It has not only entered the carbon credit market but also achieved a milestone by passing the “Nangang Branch High-Efficiency Chilled Water Machine Project” review by the Ministry of the Environment, making it the first financial institution in Taiwan to complete a voluntary greenhouse gas reduction project. The bank has also set carbon reduction targets for its financing and investment clients, encouraging them to transition to low-carbon operations, and build a sustainable ecosystem for the bank, society and environment.

Contact: Peng-Chiao Chu

Tel.: 02-2348-3794